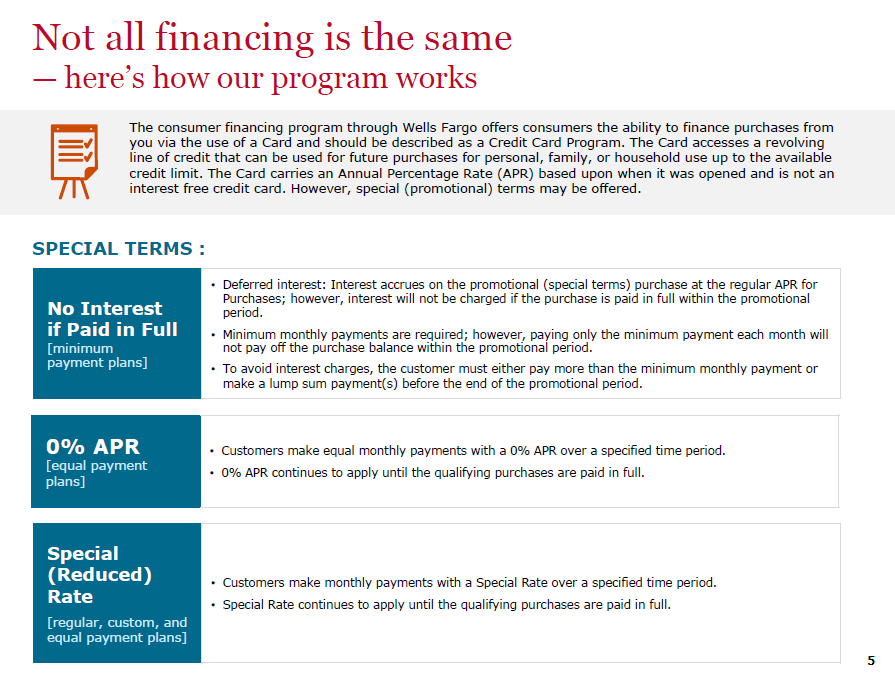

Deferred Interest refers to a borrower being able to have a month-to-month balance with the possibility of paying no interest. While the balance can result in interest over time, you can avoid paying interest by paying off the balance before a certain date. When borrowers do not pay off the balance in the allotted time, the deferred interest period expires, leaving the borrower with interest that has accrued over the given period of time.

While Deferred Interest can be extremely helpful for paying off big-ticket items like new floors or countertops, it is important for borrowers to understand the terms and conditions of Deferred Interest. To help you better understand, we have provided an example. Let’s take a look!

Deferred Interest Example

With Deferred Interest, you will notice that the lender gives you a minimum payment that is due each month. What borrowers need to understand is that you will not complete your entire payment if you only pay the minimum payment each month. In fact, you will have to pay a large leftover sum at the last month of your Deferred Interest payment period to ensure you do not pay any interest.

Here is an example:

Suzie bought new floors from ICC Home. She got approved for a 12-month financing offer and her loan total was $10,000. Each month, she decided that she only was going to make the minimum payment on her loan. In doing so, Suzie either has to pay the large remaining sum right before the end of her Deferred Interest payment period OR get charged interest on all 12-months.

The way Suzie can know what she should be paying each month is to divide 12 from $10,000. That leaves Suzie with an $834/month payment-also referred to as equal monthly payments. With Suzie paying this amount instead of the minimum payment each month, she will pay off her loan in time. Otherwise, Suzie will have to come up with all of the remaining money she owes on the loan before the payment period ends ORpay interest on all 12 months at a very high-interest rate.

It is important for borrowers to understand that the interest is slowly building in the background if you are only paying the minimum payment each month. When borrowing, if you do not want to pay interest on all 12-months (in Suzie’s case), you must make a higher payment to help you complete the entire loan before the end of the Deferred Interest payment period.

Bobby bought new countertops and cabinets from ICC Home. He got approved for a 24-month financing offer and his loan total was $20,000. With our Wells Fargo 24-month financing offer, there is 0% APR with equal payment; therefore, there is no interest accruing as long as it is paid on time.

Also, Wells Fargo financing informs customers each on how much interest is accumulating, if any, and when they need to pay off the loan prior to any ‘back interest‘ adding to the balance. Customers can stay informed by signing up for email and text message reminders to ensure they pay off the balance prior to any interest being adding.

Are you still a little confused about Deferred Interest? If so, one of our knowledgeable sales associates would love to help you learn more. Stop into our showroom to learn more.

*Terms and conditions apply. Suzie’s and Bobby’s plans are only examples. All financing is subject to credit approval.

Leave a Reply